Financial Fitness Level

Being financially fit is an essential aspect of leading a stress-free and secure life. Just like physical fitness, your financial well-being requires effort, discipline, and regular check-ups. In this article, we will explore the concept of financial fitness level and how you can assess and improve your own.

What is Financial Fitness?

Financial fitness refers to the state of having control over your finances and being able to make informed decisions that align with your goals. It involves understanding your income, expenses, savings, investments, debts, and overall financial health.

Assessing Your Financial Fitness Level

To determine your financial fitness level, you need to evaluate various aspects of your personal finances:

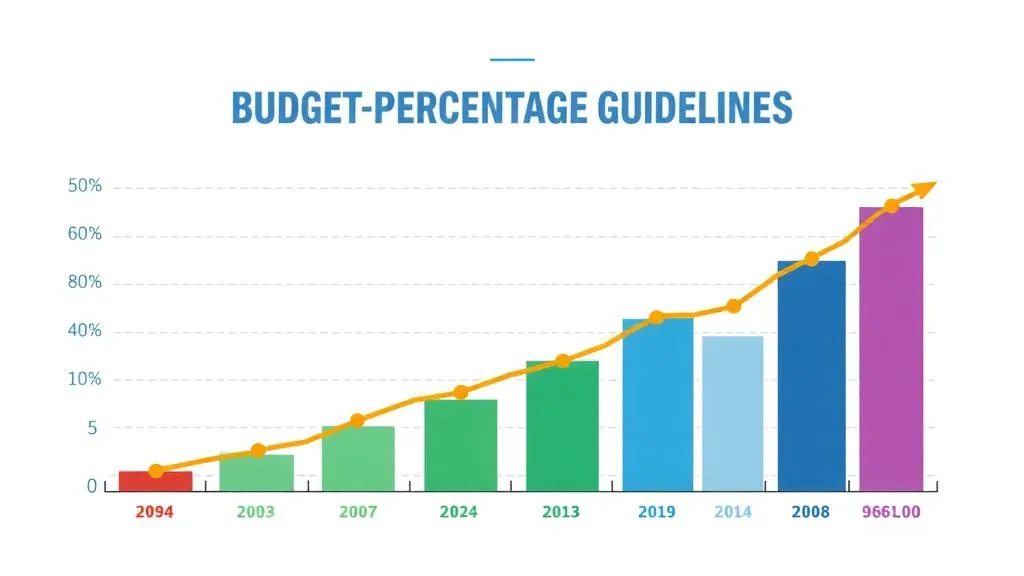

- Your budget: Are you living within your means? Do you have a budget that tracks your income and expenses?

- Savings: Do you have an emergency fund? Are you saving for retirement or other long-term goals?

- Debt management: Are you managing your debts effectively? Do you have a plan to pay off high-interest debts?

- Investments: Do you have a diversified investment portfolio? Are you taking advantage of tax-efficient investment options?

- Insurance coverage: Do you have adequate insurance coverage to protect yourself and your loved ones?

Evaluating these areas will give you a clearer picture of your financial fitness level and areas where improvement is needed.

Improving Your Financial Fitness

If you find that your financial fitness level needs improvement, don't worry! Here are some steps you can take to enhance your financial well-being:

- Create a budget: Start by tracking your income and expenses. Identify areas where you can cut back and save more.

- Build an emergency fund: Set aside some money in a separate account for unexpected expenses.

- Pay off high-interest debts: Prioritize paying off debts with high interest rates to save on interest payments.

- Invest wisely: Educate yourself about different investment options and create a diversified portfolio that aligns with your goals.

- Review insurance coverage: Regularly assess your insurance policies to ensure they adequately cover your needs.

The Benefits of Financial Fitness

Achieving and maintaining financial fitness offers numerous benefits:

- Reduced stress: When you have control over your finances, you can minimize financial stress and focus on other aspects of life.

- Improved decision-making: With a clear understanding of your finances, you can make informed decisions about spending, saving, and investing.

- Financial security: Building savings, reducing debt, and investing wisely can provide long-term financial security for yourself and your family.

In Conclusion

Your financial fitness level is crucial for achieving peace of mind and securing your future. By assessing your current situation, making necessary changes, and adopting healthy financial habits, you can improve your overall financial well-being. Remember, it's never too late to start working towards financial fitness!